Cheques are still widely used in Dubai for rent payments, business transactions, and security deposits, even as digital alternatives continue to grow.

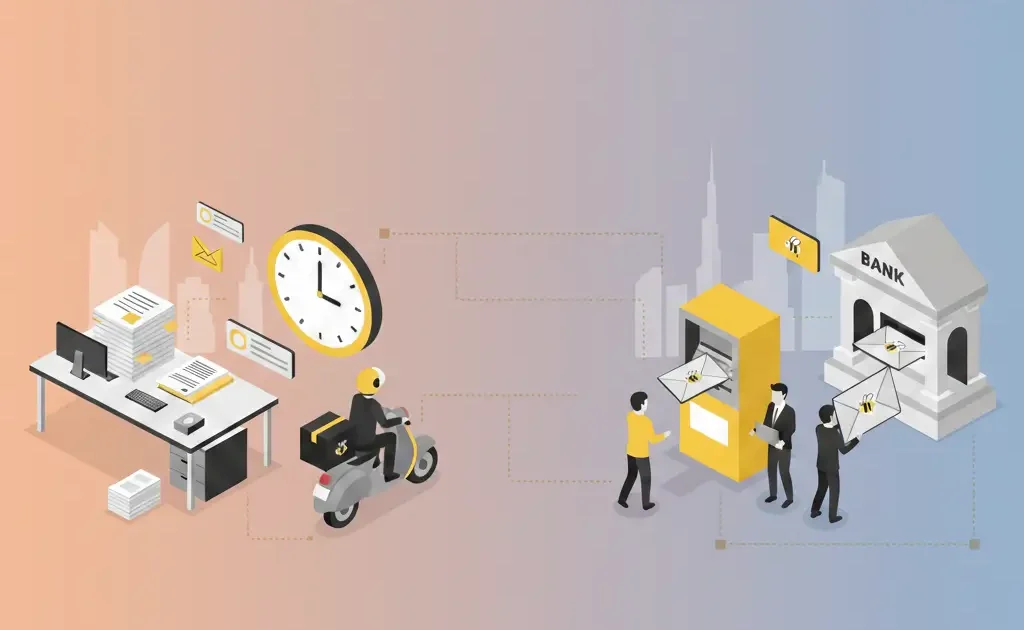

The cheque collection time cost Dubai residents and businesses face in 2026 has very little to do with bank charges. It’s mostly about time lost running between offices and branches, waiting for the management of deposits.

Plus, the Image Cheque Clearing System (ICCS) sped up the process, leaving people to assume cheque handling is now “easy.” So, let’s dive deeper into the real costs of collecting and depositing cheques and cash, not issuing them.

How Much Does Cheque Pickup and Deposit Really Take in Dubai?

Often, residents and businesses in Dubai underestimate the time involved in collecting and depositing cheques. It’s not just a casual trip to the bank. It’s coordinating, traveling, waiting, and ensuring the deposit clears without issues. Hence, becomes the real cost of bank runs Dubai 2026.

And if you’re running a business, then while handling multiple cheques or post-dated cheques (PDCs), you may lose many productive hours. So, it’s better to understand the full timeline before planning cash flow and deciding whether a deposit runner is worth it.

You can check the realistic breakdown in 2026 as:

- Coordinating handover or courier: 20–40 minutes

- Traveling to the branch or CDM: 30–60 minutes

- Queueing, verification, deposit: 10–25 minutes

- Clearing (local AED cheques): 1–3 business days

What Are the Costs of Depositing Cheques in Dubai?

Handling cheques in Dubai doesn’t usually hit your wallet hard, but the process isn’t always simple. Fees vary depending on the type of cheque, local AED or foreign currency, and whether you use a branch, ATM, or digital deposit. Planning can save time, avoid extra trips, and make cash flow management much smoother.

- Local AED cheques (same bank): Free, clears in 1–2 business days.

- Local AED cheques (different bank): Nominal fee of AED 5–10, clears in 1–3 business days.

- Foreign currency cheques: Higher fees of AED 50–200+ due to correspondent bank charges and currency conversion; clearing may take 5–45 days.

- Digital or remote deposits: Usually free or very low-cost; for example, Emirates NBD ICCS Collect allows office scanning and courier pickup.

- Business post-dated cheque (PDC) services: Pickup, archiving, and volume-based fees, often AED 2–5 per cheque depending on volume; reduces handling stress for businesses.

Typical Cheque Deposit Fees (2026)

To make it easier to compare, here’s a quick snapshot of typical cheque deposit fees and clearing times at different banks in Dubai.

| Type of Cheque | Deposit Cost | Clearing Time | Notes |

| Local, same bank | Free | 1-2 working days | Standard account deposits |

| Local, different bank | AED 5–10 | 1-3 working days | Nominal interbank fee |

| Foreign currency | AED 50–200+ | 5–45 days | Correspondent/FX fees included |

| Digital/CDM | Free / very low | 1-2 working days | Emirates NBD ICCS Collect available |

| Business PDC service | AED 2–5 per cheque | 1-3 days | Volume-based, pickup optional |

How Much Do Cash Deposits Cost in Dubai in 2026?

Depositing cash in Dubai is simple, but one can’t guarantee costs and convenience because it depends on certain conditions. These conditions include deposit method, account type, and transaction volume, etc.

ATM/CDM Deposits

You can use ATMs or CDMs, usually free of cost at major banks like Emirates NBD, FAB, and ADCB. This self-service method is fast, convenient, and reduces the need for branch visits.

Branch Teller Deposits

Branch deposits often come with a monthly free limit. For example, Dubai Islamic Bank allows the first 10 deposits per month free, after which each transaction costs AED 10.50.

Bulk or Large Deposits

Businesses making large deposits may face a small percentage-based fee, such as 0.26%, depending on the bank and the total cash volume.

Foreign Currency Deposits

Deposits in foreign currency incur conversion fees, which vary depending on the current exchange rate.

But if you’re using self-service channels like ATMs, CDMs, or banking apps, it’s a plus point as it prevents the hidden costs.

Cheque and Cash Deposit Fees Across Dubai Banks

Each bank in Dubai has slightly different fees, limits, and digital options. So, you can compare these aspects first and then choose the most convenient and cost-effective bank for your needs.

| Bank | Local Cheque Deposit (Different Bank) | Cash Deposit (ATM/CDM) | Cash Deposit (Teller) |

| Emirates NBD | Free / AED 5–10 | Free | Limits may apply |

| Dubai Islamic Bank | Free/low | Free | First 10 free/month, AED 10.50 after |

| First Abu Dhabi Bank (FAB) | AED 5–10 | Free | Possible fees for bulk |

| CBD | Low/nominal | Free | Check SOC |

Note: Fees are inclusive of 5% VAT; always verify SOC 2026 updates on the bank website.

What Are the Hidden Costs of Cheque Collection in Dubai?

Usually, most people think about the obvious fees while depositing cheques. But in reality, the hidden costs often take a bigger toll. Time spent waiting, coordinating deposits, and managing multiple cheques can quietly add up, especially for businesses handling large volumes or post-dated cheques.

Even with faster systems like ICCS and digital deposits, these “invisible” costs affect productivity, cash flow, and operational stress.

- Clearing delays: Funds tied up 1–3 days, or longer for foreign cheques.

- Returned cheques: Verification and follow-up take time.

- Bulk handling for businesses: Physical deposits consume staff hours; outsourcing costs money but saves stress.

Tips to Minimize Costs and Stress

We’ve collected some essential tips that you can use to minimize the cheque and cash deposit fees in Dubai banks.

- Avoid using Apps and CDMs: they save trips but may require setup or service fees.

- Prefer the use of ATMs, CDMs, and mobile apps to avoid teller fees.

- Choose accounts with unlimited free teller transactions.

- For businesses: consider deposit runners or cash/cheque management services.

- Always opt for batch deposits instead of daily trips.

- Track post-dated cheques digitally, not manually.

- Always check the latest Schedule of Charges (SOC) for Emirates NBD, CBD, and other banks.

Digital Payments vs Cheques: What’s Changing in Dubai in 2026

Dubai is steadily moving toward faster, digital-first payments. Keeping an eye on cheque usage and alternatives can save time, reduce stress, and help residents and businesses stay a step ahead.

Digital payments like UAEFTS and direct debit for rent are becoming the norm, while cheques are gradually declining for low-value or recurring payments. Bounced cheque issues are mostly civil after the 2022 reforms, but handling them still adds stress. Banks like Emirates NBD and CBD offer ICCS-based services, though cheques remain slower than digital options (Central Bank UAE).

Conclusion

Most cheque and cash deposits are low-cost or free when you use self-service channels in Dubai. However, the real cost comes from time spent running between offices, waiting for clearing, and managing post-dated cheques.

If you want to save hours and reduce the operational stress of outsourcing cheque collection and deposit management, ErrandBee is always there to help you. But always verify the latest SOC 2026 on official bank websites before making deposit decisions.